Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Mar, 2022

By John Wu

|

|

People line up at the ATM of Sberbank, which is included on the sanctions list by the EU and the U.S., on Feb. 28 in Moscow, Russia. |

The latest sanctions on Russia could push Moscow and Beijing to further their partnership in cross-border payments, at best a limited alternative for now.

Russia is turning to China to explore workarounds after several Russian banks were banned from the Society for Worldwide Interbank Financial Telecommunication, or Swift. The central banks of the two nations are "establishing cooperation" between their financial messaging systems, Anatoly Aksakov, head of the financial committee in Russia's lower house of parliament, said March 16.

The move for Russia's System for Transfer of Financial Messages, or SPFS, and China's Cross-Border Interbank Payment System, or CIPS, aims to "get rid of risks associated with maintaining trade turnover," Aksakov said in the video posted on his website.

In addition, Russian lenders such as Sberbank of Russia, Joint Stock Company Tinkoff Bank and JSC Alfa-Bank said in separate statements on their Telegram accounts in early March that they were working on or considering the possibility of issuing new credit cards using China Unionpay Co. Ltd. The plan to join China's global card processing system came after Visa Inc. and Mastercard Inc. suspended operations in Russia.

If Russia continues to be ousted from the dollar-denominated Swift network, it would have to rely on the yuan-denominated global financial system, said Shirley Ze Yu, a political economist and a fellow at Harvard Kennedy School's Ash Center.

CIPS, its owner People's Bank of China and UnionPay could not be reached for comment. Russia's SPFS and its owner Central Bank of the Russian Federation did not reply to requests for comment. Sberbank, Tinkoff Bank and Alfa-Bank declined to comment further than the statements they issued earlier.

Russian President Vladimir Putin and Chinese President Xi Jinping vowed to stay committed to each other as recently as early February. During the opening of the Beijing Winter Olympics, China signed new Russian oil and gas deals worth an estimated US$117.5 billion and issued a wide-ranging joint statement underscoring their bilateral economic ties and deepening strategic coordination of mutual support.

"This is a strategic choice that will have a far-reaching impact on China, Russia and the rest of the world. The two countries have never and will never waver in this choice," reads a Feb. 4 statement from China's Ministry of Foreign Affairs.

The financial ties between China and Russia have been deepening since 2014. Both countries said they would develop shared financial infrastructures to service trade and fund flows and called for increasing the use of the yuan and ruble in mutual settlements, which is in line with China's ongoing efforts to internationalize the use of its currency.

Messaging matters

Russia's SPFS transmits financial messages such as money transfer instructions mostly within the country. The exclusion from Swift means the banned Russian banks have to find other ways, such as emails or encrypted telegrams, to communicate financial messages with other banks in cross-border payments, analysts said.

"Financial transactions will become more expensive and slower, since some additional steps, additional intermediaries, will probably be needed to circumvent the restrictions," said Igor Dodonov, an analyst at Moscow-based brokerage company Finam.

CIPS, launched in 2015, allows financial messages associated with the transactions it handles to go through either itself or Swift. Unlike Swift, CIPS also settles and clears cross-border payments, but only for transactions that use Chinese yuan.

The Chinese system has 76 direct participants, mostly overseas branches of Chinese banks, and does not include any Russian entities. In addition, it has 1,212 indirect participants across about 100 countries, according to its official website. Swift's network has over 11,000 participating institutions across more than 200 countries.

CIPS' direct participants can choose to send financial messages through either the Chinese system or Swift, while indirect participants can do so only via Swift, according to a March 16 report by China-based Xiangcai Securities Co.

Limited capacity

Despite prospects of increasing cooperation on cross-border financial messaging, China's homegrown payment system is still too small and too narrow in scope to replace Russia's lost access to the international financial system, analysts said.

CIPS handles about 5% of the volume that Swift does, according to Junyu Tan, an economist at French investment bank Natixis specializing in Asia thematic research.

"The space will be quite limited in the short run for China's financial infrastructure to help with the sanctions on Swift for Russia," Tan said in a call with journalists March 7. "Over time, it can become a second best, but possibly a far distant second best."

"Building mutual financial infrastructure is possible but not probable, because participants from the Chinese side would be opening themselves for sanctions, although [it] can be done with those that have no overseas exposures, such as development banks," said Rodrigo Zeidan, a finance and economics professor at New York University Shanghai. "There would be [a] political cost for China, who claims itself neutral, if such a system is built, yet the benefit would be so little due to the difference of the sizes of economy."

China, the economy of which was about 10 times the size of Russia's in 2021, has in the past provided financing to countries under international sanctions through its policy banks. Iran signed in 2017 a loan agreement of about US$15 billion with China Development Bank, one of the nation's three policy banks that focuses on financing infrastructure projects, according to various media reports. In addition, China Development Bank in 2009 signed a US$25 billion loan agreement with Russian oil companies Rosneft and Transneft in exchange for supplies of 15 million tons of Russian oil every year over a period of 20 years, the reports said.

"Chinese banks as a system will need to be prepared to avoid settlement risks amid Swift sanction against Russia," according to Xiangcai Securities' March 16 report. China may push for "a more comprehensive and regional payment infrastructure over [the] medium-to-long term" since CIPS is too small to replace Swift, it said.

China Development Bank could not be reached for comment.

Yuan only

"What Russian needs is hard currencies, which they won't be able to get from a shared financial infrastructure with China, if any, which provides only yuan that can only buy Chinese goods," Zeidan said. "The yuan is not a convertible currency, they still don't have easy access to other currencies."

Over 17% of bilateral trade between China and Russia was settled in yuan, which accounted for about 12% of Russia's foreign exchange reserves, according to a Chinese government statement issued Feb. 9.

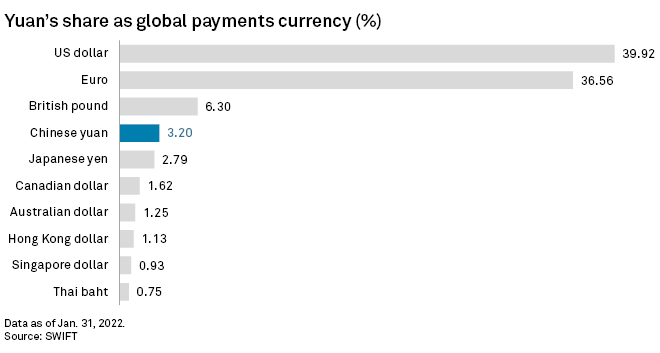

The yuan was the world's fourth-most-used currency in global payments in January, with a market share of 3.2%, according to Swift. The Chinese currency trailed the dollar, euro and British pound.

In trade finance, the yuan was the world's third-most-used currency, with a market share of 1.92%, after the dollar and euro, with a market share of 87.38% and 5.76%, respectively.

China and Russia have reduced their use of the dollar in bilateral trade significantly amid rounds of sanctions from the U.S. and other developed economies in recent years. Among the latest arrangements, PJSC Gazprom Neft said in September 2021 that it would use the yuan instead of the dollar in settlements for fueling planes in China, according to a Reuters report citing the CEO of the oil arm of Public Joint Stock Company Gazprom.

"Ultimately, the strength of the [yuan] will come from China's capital market deepening and reform," Harvard's Yu said. "More than the size of the economy, the size of trade, or the stability of the currency, what determines the power and strength of a global currency is the depth and width of the financial markets" in which it operates.

As of March 25, US$1 was equivalent to 6.37 Chinese yuan and 101.22 Russian rubles.